This article analyzes the potential impact of the upcoming U.S.-Ukraine mineral agreement, which could become a strategic turning point in bilateral relations and post-war reconstruction. It also assesses the short-term risks facing silver prices amid shi

On Wednesday (April 30) during the Asian session, London silver is trading above the 32.79 level, opening at 32.89 USD per ounce. As of writing, it stands at 33.07 USD per ounce, rising by 0.43%, reaching a high of 33.10 and a low of 32.84. The intraday trend appears to lean bullish.

U.S.-Ukraine Mineral Deal May Mark Strategic Turning Point; Silver Faces Short-Term Downside Risk

[Key News Updates]

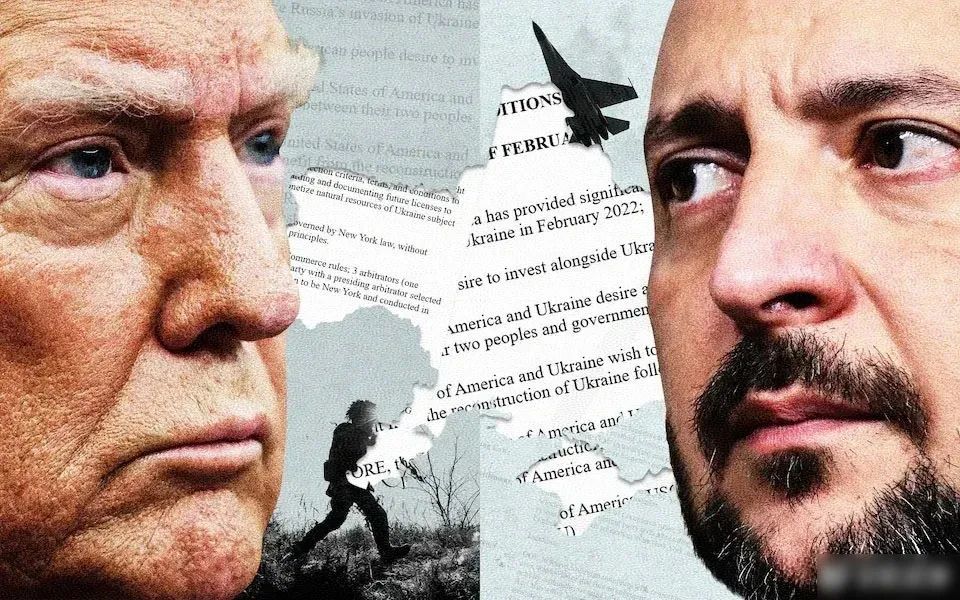

A spokesperson from the U.S. Department of State recently stated that Secretary of State Rubio has explicitly demanded that Russia and Ukraine submit concrete reconciliation proposals soon, warning that if no substantive progress is made, the U.S. may consider withdrawing from the mediation process. Rubio emphasized that the next week is a “critical window” for ending the war between Russia and Ukraine, requiring a strategic decision from Washington.

Notably, President Trump met informally with Ukrainian President Zelenskyy to discuss conflict resolution. However, sources reveal that some European and Ukrainian officials are concerned that the U.S. is nearing a retreat from its mediator role and might even declare its mission complete by citing "partial success in negotiations."

White House spokesperson Karoline Leavitt confirmed on Tuesday that the Trump administration is accelerating key mineral resource agreement talks with Ukraine. The deal aims to regulate post-war mineral exploration and infrastructure reconstruction, seen by the U.S. as a core step toward reclaiming billions in investment and localizing critical mineral supply chains. Leavitt said Trump is confident about signing the agreement, believing it will strengthen long-term support to Kyiv while aiding Ukraine’s post-war recovery. Sources say both sides have targeted this week for signing the agreement, aiming to mark a diplomatic breakthrough.

[Latest London Silver Analysis]

Unless the 32.65 support level holds firm, silver’s short-term outlook remains bearish. A break below could lead to a pullback toward 31.45 USD. However, strong industrial demand—especially from green-tech and manufacturing sectors in Asia—should help limit further downside. Confirmation of increased physical buying or better-than-expected U.S. data may help the market find a bottom and re-approach higher levels.