Inthecurrentglobalfinancialmarketlandscape,theperformancesofgoldandtheUSstockmarketpresentasharpcontrast.TheS&P500Index(SPX)hasexperiencedasignificantcorrectionsincehitt

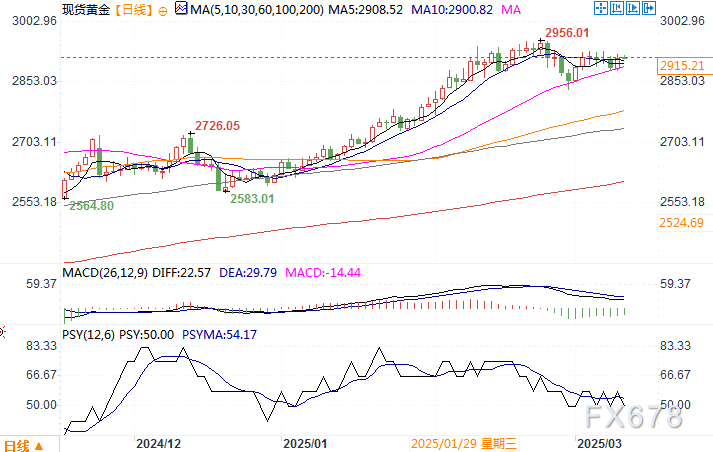

In the current global financial market landscape, the performances of gold and the US stock market present a sharp contrast. The S&P 500 Index (SPX) has experienced a significant correction since hitting its high in February, with a decline of 8.9%. In contrast, the gold price has been trading in a range around $2,900 per ounce, and its market performance is significantly better than that of the broader stock market, highlighting the unique value of gold in asset allocation.

Market concerns about the global trade war are escalating. Investors worry that the trade conflict will push the US and the global economy into a recession. This panic sentiment has triggered a large - scale sell - off in the stock market, leading to a significant decline in the S&P 500 Index. In this volatile market environment, gold has shown strong resilience.

Judging from market data, gold's performance during stock market downturns is not accidental. FX678, with the help of ChatGPT, found that when the SPX corrects by 10%, spot gold usually experiences a mild increase. During typical correction periods such as the 2008 financial crisis and the market downturn caused by the pandemic, the average decline of the SPX is between 10% - 15%, while the increase of spot gold ranges from 3% - 5%. In some severe correction phases, the appreciation of gold is even higher. Through statistical calculations of historical price data, the Pearson correlation coefficient between the SPX and the spot gold price (XAUUSD) is approximately -0.12. During stock market declines, this negative correlation strengthens to around -0.30, indicating that gold often moves in the opposite direction during stock market adjustments, effectively mitigating investment risks.

Many professional analysts are optimistic about the future trend of the gold market. George Milling - Stanley, the chief gold strategist at State Street Global Advisors, pointed out that recently, a large number of investors have flocked to gold ETFs to preserve and increase the value of their assets, resulting in strong demand in the gold market. He expects that the gold price will continue to be strongly supported. Last month, when the SPX started to decline, the world's largest gold ETF, SPDR Gold Shares, saw a single - day capital inflow of as much as $1.9 billion, the largest increase in more than three years, which fully reflects the market's preference for gold.

Ryan McIntyre, the executive partner of Sprott Inc., said that from multiple indicators, the stock market has been overvalued for a long time, and this significant correction is within expectations. The economic uncertainty brought about by tariff policies and the global trade war has seriously affected long - term corporate planning, suppressed capital investment, and negatively impacted the returns of most assets. However, gold can stand out in such an environment.

Even if the gold price may face certain selling pressure in the short term, most analysts still believe that corrections are excellent buying opportunities. Bart Melek, the head of commodity strategy at TD Securities, pointed out in a report that although market volatility may cause the gold price to drop to $2,800 per ounce in the short term, the long - term upward trend of gold remains unchanged. Considering that inflation in the US is higher than the target level and as the economy slows down, the Federal Reserve is expected to increase monetary easing policies to promote employment. It is predicted that in 2025, the gold price will break through $3,000 per ounce and enter a higher trading range.